C/O form E: Things to note

In the international trade environment, CO Form E plays an important role in determining the origin of goods and applying preferential import tax rates. This is an important document used in the ASEAN-China Export Protocol (ACFTA), helping to ensure legality and preferential tax rates for export shipments. In this article, we will learn in-depth about CO Form E, from the basic concept, processing time, to necessary documents and detailed content in this document. Let's explore to better understand this important process in international trade.

1. Concept of C/O form E

C/O form E is a Certificate of Origin form E, issued under the ASEAN-China Comprehensive Economic Cooperation Framework Agreement (ACFTA), certifying that the goods originate from a member country of the agreement. this decision.

The purpose of C/O form E is to confirm the origin of the goods, from which to see whether the shipment is eligible for special preferential import tax rates or not. Specifically, the import tax rate will depend on each specific type of product, based on the HS Code.

2. Agency issuing C/O form E

– Import-Export Management Departments of the Ministry of Industry and Trade

– Export Processing and Industrial Park Management Boards are authorized by the Ministry of Industry and Trade.

3. Application for issuance of C/O form E

+ Application for issuance of C/O

+ Completely declared C/O form (1 original and 3 copies)

+ Customs declaration has been cleared

+ Commercial Invoice/ Packing list

+ Production process explanation table

+ Bill of Lading

+ Other documents

+ For businesses participating in eCOSys, documents will be electronically signed and automatically transmitted to C/O issuing organizations. C/O issuing organizations rely on online records to check the validity of information and issue C/O to traders upon receiving a complete set of paper documents.

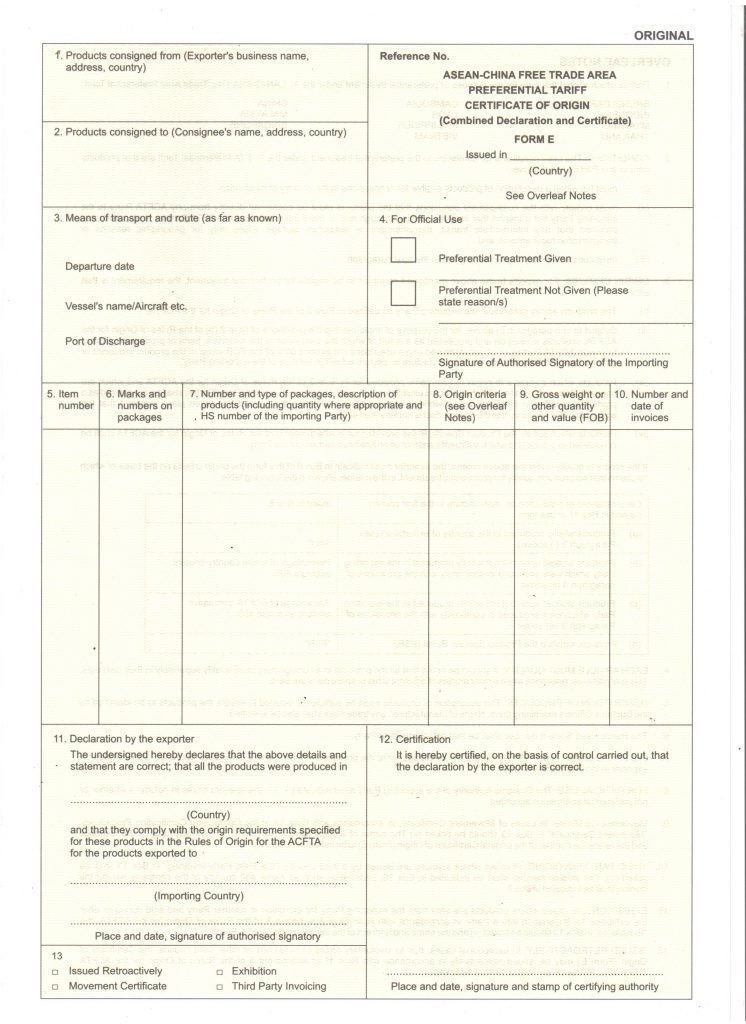

4. Main content in C/O

Box number 1: Exporter information: company name, address. Usually the seller on Invoice, except in the case of a 3rd party invoice (in this box is the name of the manufacturing company).

Box number 2: Information of consignee (importer).

Box number 3: Name of means of transport and route.

Box number 4: for C/O issuing agencies.

Box 7: Quantity, packaging type, description of goods (including quantity and HS code of the importing country).

Box 8: Origin criteria. It shows what percentage of the value of goods is produced in the country issuing the C/O.

Some common cases:

+ “WO” = Wholy Owned: pure origin, meaning 100%

+ Number % means % of goods produced in the country issuing the C/O

+ Origin content value below 40% is considered non-origin as required.

Box 9: Gross weight and FOB value. If the invoice states the value according to other conditions, such as EXW, CIF... then do not immediately enter this box number 9, but must adjust the addition and subtraction of costs to determine the correct FOB value.

Box number 10: Invoice number and date..

Box number 11: Name of exporting and importing country, location and date of application for C/O, along with the stamp of the company applying for C/O.

Box number 12: Confirm the signature of the authorized person, stamp of the C/O issuing organization, location and date of issue.

Box number 13: Some options, tick the corresponding box if that is the case:

+ Issued Retroactively: In case the C/O is issued after 3 days of the train running

+ Exhibition: In case the goods participate in an exhibition and are sold after the exhibition.

+ Movement Certificate: In case the goods are issued back-to-back C/O

+ Third Party Invoicing: In case the invoice is issued at a Third Party

5.Notes when applying for C/O form E:

+ The application for issuance of C/O and C/O form E is fully filled out according to the regulations on the back of C/O form E and signed by an authorized person.

+ Origin of goods complies with regulations in Circular 12/2019/TT-BCT of the Ministry of Industry and Trade

+ Other information on C/O form E is consistent with the attached documents

+ Description of goods, quantity and weight of goods, symbol and number of packages, quantity and type of packages declared in accordance with exported goods

+ Multiple items can be declared on the same C/O form E with the condition that each item must meet the origin regulations for that item.

Above are some shares about C/O form E. If you have questions that need answering or need to transport import and export goods, please contact Macsco Logistics immediately with a team of many years of experience to Get the fastest and most accurate support.

For further information and questions, please contact:

MACSCO LOGISTICS LIMITED

Address: 64 Nguyen Dinh Chieu, Da Kao Ward, District 1, Ho Chi Minh City, Vietnam

Phone: (84 28) 6270 6576

Email: anna@macsclogistics.com

Website: https://macscologistics.com